This report focuses on the global Internet Insurance status, future forecast, growth opportunity, key market and key players. The study objectives are to present the Internet Insurance development in North America, Europe, China, Japan, Southeast Asia, India and Central & South America. The key players covered in this study Lifenet Insurance Allstate Inweb Money Super Market PICC Group Ping An Group AIG Zhongmin Huize China Life Market segment by Type, the product can be split into Life Insurance Property Insurance Comparison of Insurance Market segment by Application, split into Personal Group Market segment by Regions/Countries, this report covers North America Europe China Japan Southeast Asia India Central & South America The study objectives of this report are: To analyze global Internet Insurance status, future forecast, growth opportunity, key market and key players. To present the Internet Insurance development in North America, Europe, China, Japan, Southeast Asia, India and Central & South America. To strategically profile the key players and comprehensively analyze their development plan and strategies. To define, describe and forecast the market by type, market and key regions. In this study, the years considered to estimate the market size of Internet Insurance are as follows: History Year: 2015-2019 Base Year: 2019 Estimated Year: 2020 Forecast Year 2020 to 2026 For the data information by region, company, type and application, 2019 is considered as the base year. Whenever data information was unavailable for the base year, the prior year has been considered.

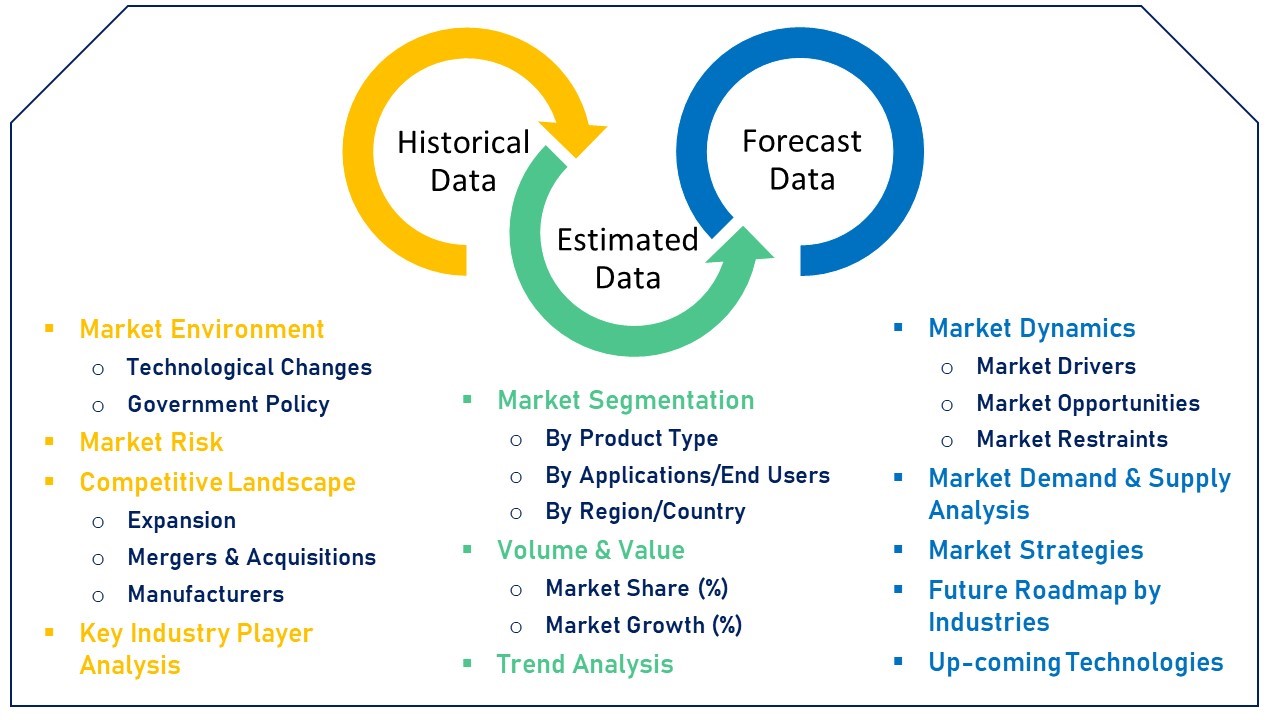

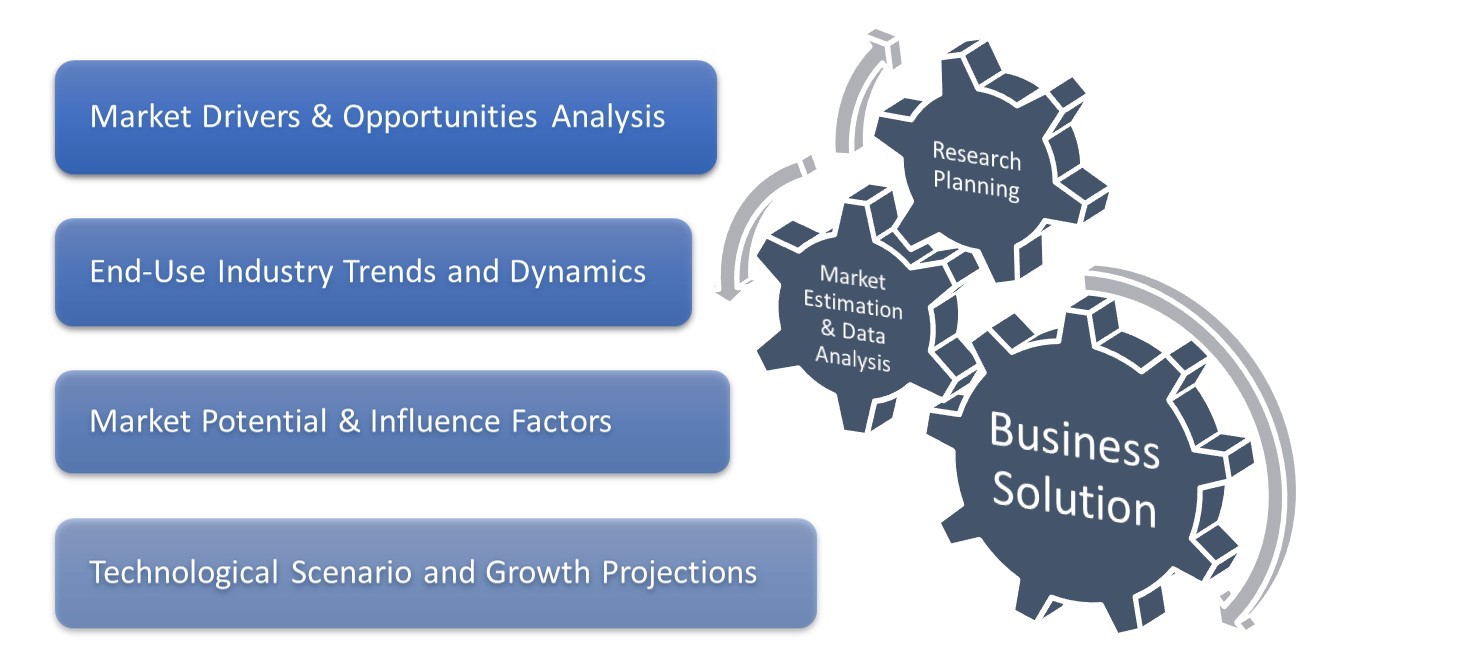

This research study involves broad usage of both secondary and primary data sources. The research process involves the identification of numerous factors which affect the industry, comprising the market environment, government policy, historical data, present trends in the market, competitive landscape, technological innovation, upcoming technologies and the technical progress in related industry, and market risks, opportunities, market barriers and challenges.

Market Estimation

Top-down and bottom-up approaches are used for validating the market size for companies, regional segments along with relevant market segmentations such as product type and application.

This report includes market estimations which are based on the marketed sale price of a product. Further breakdown of product segments, particular market share are formed based on the weightage assigned to every segment, which is derived of their usage rate and average price. The entire probable factors which effect the markets and influence them in a great way are included in this research report; and have been accounted for, studied in-depth and are confirmed through primary research. These are then studies to get the final qualitative and quantitative data. Any of the factors such as the outcome of inflation, economic downfall, and any kind of policy and regulatory alterations and/or other such factors are not accounted for in the market forecast. All of this data is amalgamated and included with thorough inputs and analysis from Gravitas Market Insights is curated in this report.

Along with the previously mentioned approaches, various data triangulation methods, in order to conduct market estimations and market forecasting for the complete market segments are detailed in this report. Key Companies present in the said market are also acknowledged via in-depth secondary research and primary research.

1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Players Covered: Ranking by Internet Insurance Revenue 1.4 Market Analysis by Type 1.4.1 Global Internet Insurance Market Size Growth Rate by Type: 2020 VS 2026 1.4.2 Life Insurance 1.4.3 Property Insurance 1.4.4 Comparison of Insurance 1.5 Market by Application 1.5.1 Global Internet Insurance Market Share by Application: 2020 VS 2026 1.5.2 Personal 1.5.3 Group 1.6 Coronavirus Disease 2019 (Covid-19): Internet Insurance Industry Impact 1.6.1 How the Covid-19 is Affecting the Internet Insurance Industry 1.6.1.1 Internet Insurance Business Impact Assessment - Covid-19 1.6.1.2 Supply Chain Challenges 1.6.1.3 COVID-19?s Impact On Crude Oil and Refined Products 1.6.2 Market Trends and Internet Insurance Potential Opportunities in the COVID-19 Landscape 1.6.3 Measures / Proposal against Covid-19 1.6.3.1 Government Measures to Combat Covid-19 Impact 1.6.3.2 Proposal for Internet Insurance Players to Combat Covid-19 Impact 1.7 Study Objectives 1.8 Years Considered 2 Global Growth Trends by Regions 2.1 Internet Insurance Market Perspective (2015-2026) 2.2 Internet Insurance Growth Trends by Regions 2.2.1 Internet Insurance Market Size by Regions: 2015 VS 2020 VS 2026 2.2.2 Internet Insurance Historic Market Share by Regions (2015-2020) 2.2.3 Internet Insurance Forecasted Market Size by Regions (2021-2026) 2.3 Industry Trends and Growth Strategy 2.3.1 Market Top Trends 2.3.2 Market Drivers 2.3.3 Market Challenges 2.3.4 Porter?s Five Forces Analysis 2.3.5 Internet Insurance Market Growth Strategy 2.3.6 Primary Interviews with Key Internet Insurance Players (Opinion Leaders) 3 Competition Landscape by Key Players 3.1 Global Top Internet Insurance Players by Market Size 3.1.1 Global Top Internet Insurance Players by Revenue (2015-2020) 3.1.2 Global Internet Insurance Revenue Market Share by Players (2015-2020) 3.1.3 Global Internet Insurance Market Share by Company Type (Tier 1, Tier 2 and Tier 3) 3.2 Global Internet Insurance Market Concentration Ratio 3.2.1 Global Internet Insurance Market Concentration Ratio (CR5 and HHI) 3.2.2 Global Top 10 and Top 5 Companies by Internet Insurance Revenue in 2019 3.3 Internet Insurance Key Players Head office and Area Served 3.4 Key Players Internet Insurance Product Solution and Service 3.5 Date of Enter into Internet Insurance Market 3.6 Mergers & Acquisitions, Expansion Plans 4 Breakdown Data by Type (2015-2026) 4.1 Global Internet Insurance Historic Market Size by Type (2015-2020) 4.2 Global Internet Insurance Forecasted Market Size by Type (2021-2026) 5 Internet Insurance Breakdown Data by Application (2015-2026) 5.1 Global Internet Insurance Market Size by Application (2015-2020) 5.2 Global Internet Insurance Forecasted Market Size by Application (2021-2026) 6 North America 6.1 North America Internet Insurance Market Size (2015-2020) 6.2 Internet Insurance Key Players in North America (2019-2020) 6.3 North America Internet Insurance Market Size by Type (2015-2020) 6.4 North America Internet Insurance Market Size by Application (2015-2020) 7 Europe 7.1 Europe Internet Insurance Market Size (2015-2020) 7.2 Internet Insurance Key Players in Europe (2019-2020) 7.3 Europe Internet Insurance Market Size by Type (2015-2020) 7.4 Europe Internet Insurance Market Size by Application (2015-2020) 8 China 8.1 China Internet Insurance Market Size (2015-2020) 8.2 Internet Insurance Key Players in China (2019-2020) 8.3 China Internet Insurance Market Size by Type (2015-2020) 8.4 China Internet Insurance Market Size by Application (2015-2020) 9 Japan 9.1 Japan Internet Insurance Market Size (2015-2020) 9.2 Internet Insurance Key Players in Japan (2019-2020) 9.3 Japan Internet Insurance Market Size by Type (2015-2020) 9.4 Japan Internet Insurance Market Size by Application (2015-2020) 10 Southeast Asia 10.1 Southeast Asia Internet Insurance Market Size (2015-2020) 10.2 Internet Insurance Key Players in Southeast Asia (2019-2020) 10.3 Southeast Asia Internet Insurance Market Size by Type (2015-2020) 10.4 Southeast Asia Internet Insurance Market Size by Application (2015-2020) 11 India 11.1 India Internet Insurance Market Size (2015-2020) 11.2 Internet Insurance Key Players in India (2019-2020) 11.3 India Internet Insurance Market Size by Type (2015-2020) 11.4 India Internet Insurance Market Size by Application (2015-2020) 12 Central & South America 12.1 Central & South America Internet Insurance Market Size (2015-2020) 12.2 Internet Insurance Key Players in Central & South America (2019-2020) 12.3 Central & South America Internet Insurance Market Size by Type (2015-2020) 12.4 Central & South America Internet Insurance Market Size by Application (2015-2020) 13 Key Players Profiles 13.1 Lifenet Insurance 13.1.1 Lifenet Insurance Company Details 13.1.2 Lifenet Insurance Business Overview and Its Total Revenue 13.1.3 Lifenet Insurance Internet Insurance Introduction 13.1.4 Lifenet Insurance Revenue in Internet Insurance Business (2015-2020)) 13.1.5 Lifenet Insurance Recent Development 13.2 Allstate 13.2.1 Allstate Company Details 13.2.2 Allstate Business Overview and Its Total Revenue 13.2.3 Allstate Internet Insurance Introduction 13.2.4 Allstate Revenue in Internet Insurance Business (2015-2020) 13.2.5 Allstate Recent Development 13.3 Inweb 13.3.1 Inweb Company Details 13.3.2 Inweb Business Overview and Its Total Revenue 13.3.3 Inweb Internet Insurance Introduction 13.3.4 Inweb Revenue in Internet Insurance Business (2015-2020) 13.3.5 Inweb Recent Development 13.4 Money Super Market 13.4.1 Money Super Market Company Details 13.4.2 Money Super Market Business Overview and Its Total Revenue 13.4.3 Money Super Market Internet Insurance Introduction 13.4.4 Money Super Market Revenue in Internet Insurance Business (2015-2020) 13.4.5 Money Super Market Recent Development 13.5 PICC Group 13.5.1 PICC Group Company Details 13.5.2 PICC Group Business Overview and Its Total Revenue 13.5.3 PICC Group Internet Insurance Introduction 13.5.4 PICC Group Revenue in Internet Insurance Business (2015-2020) 13.5.5 PICC Group Recent Development 13.6 Ping An Group 13.6.1 Ping An Group Company Details 13.6.2 Ping An Group Business Overview and Its Total Revenue 13.6.3 Ping An Group Internet Insurance Introduction 13.6.4 Ping An Group Revenue in Internet Insurance Business (2015-2020) 13.6.5 Ping An Group Recent Development 13.7 AIG 13.7.1 AIG Company Details 13.7.2 AIG Business Overview and Its Total Revenue 13.7.3 AIG Internet Insurance Introduction 13.7.4 AIG Revenue in Internet Insurance Business (2015-2020) 13.7.5 AIG Recent Development 13.8 Zhongmin 13.8.1 Zhongmin Company Details 13.8.2 Zhongmin Business Overview and Its Total Revenue 13.8.3 Zhongmin Internet Insurance Introduction 13.8.4 Zhongmin Revenue in Internet Insurance Business (2015-2020) 13.8.5 Zhongmin Recent Development 13.9 Huize 13.9.1 Huize Company Details 13.9.2 Huize Business Overview and Its Total Revenue 13.9.3 Huize Internet Insurance Introduction 13.9.4 Huize Revenue in Internet Insurance Business (2015-2020) 13.9.5 Huize Recent Development 13.10 China Life 13.10.1 China Life Company Details 13.10.2 China Life Business Overview and Its Total Revenue 13.10.3 China Life Internet Insurance Introduction 13.10.4 China Life Revenue in Internet Insurance Business (2015-2020) 13.10.5 China Life Recent Development 14 Analyst's Viewpoints/Conclusions 15 Appendix 15.1 Research Methodology 15.1.1 Methodology/Research Approach 15.1.2 Data Source 15.2 Disclaimer 15.3 Author Details