Extract:

Based on this comprehensive report published by Gravitas Market Insights, the Usage-based Insurance (UBI) market is said to witness a significant growth during the forecast years between 2021 and 2028. Usage-based Insurance (UBI) Market is predicted to grow in the coming years owing to the increased adoption of telematics and several other communication technologies to observe the boost in the said industry. Also, rising number of smartphone usage by consumers is backing the demand of this industry.

Report Scope in detail:

This latest report edition of Usage-based Insurance (UBI) market has been added to our huge database of detailed reports and this envisions to shape the future of all the related businesses. Our team of learned research analysts have studied in-depth and curated the report based on several aspects which include the overview of the market, driving forces, growth rate, market trends, market size, opportunities and challenges of the market; along with detailed competitive analysis on the regional as well as global level. The Usage-based Insurance (UBI) market research report renders a thorough analysis of the market on a global aspect and aims on several market segmentation. This report also provides deeper perception into the latest trends of the market and pinpoints crucial product developments of the industry. Furthermore, the report collects numerous factors that have accredited to the growth of the market in the recent years.

Usage-based Insurance (UBI) Market Segmentation:

By Package

- Pay-As-You-Drive (PAYD)

- Pay-How-You-Drive (PHYD)

By Technology

- Smartphone

- OBD-II

- Black Box

- Embedded telematics

By Vehicle Type

- Commercial vehicle

- Passenger vehicle

Regional Coverage

- North America

- United States

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Korea

- Australia

- Southeast Asia

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Colombia

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Competitive Analysis:

Eminent market players have been outlined in order to extract improved insights into the worldwide businesses. Our research reports offer all-inclusive information on various top most manufacturers that are operational across global regions. We provide company profiles which include detailed overview of the company, business information, business performance, crucial strategies implemented through the years.

Few of the Key Players Covered in Our Report:

- Allstate Insurance Company

- Aviva plc

- Allianz SE

- ASSICURAZIONI GENERALI S.P.A.

- Cambridge Mobile Telematics

- AXA

- Danlaw, Inc.

- Intelligent Mechatronic Systems Inc.

- Desjardins Group

- Liberty Mutual Insurance

- Metromile Inc.

Impact of COVID19:

The COVID19 pandemic crippled the global economy, it resulted in a worldwide lockdown and this has majorly impacted numerous industries. Our industry experts are working round-the-clock to identify, accumulate and in-time deliver market analysis due to the effect of unprecedented decisions in COVID-19 repercussions on many businesses. The full version of this report will comprise the overall impact of the pandemic, and predicted alteration on the future outlook of the industry, by taking into the account the economic, political, technological and social parameters.

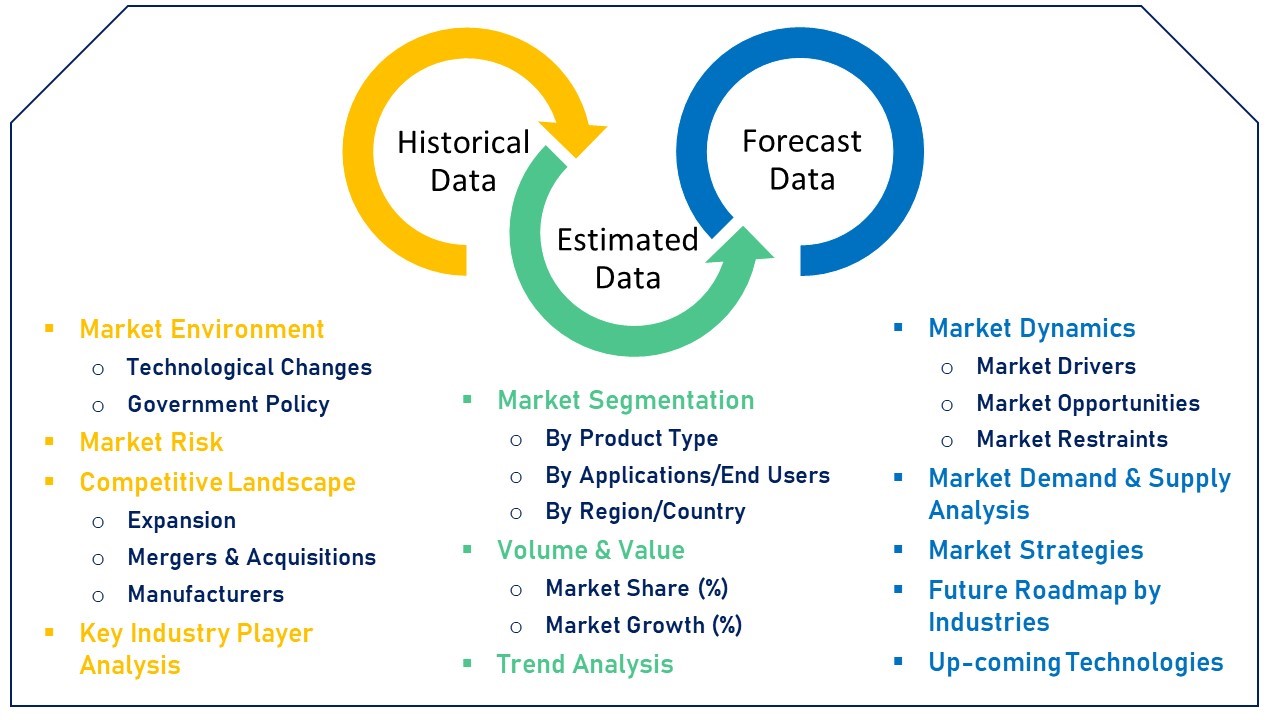

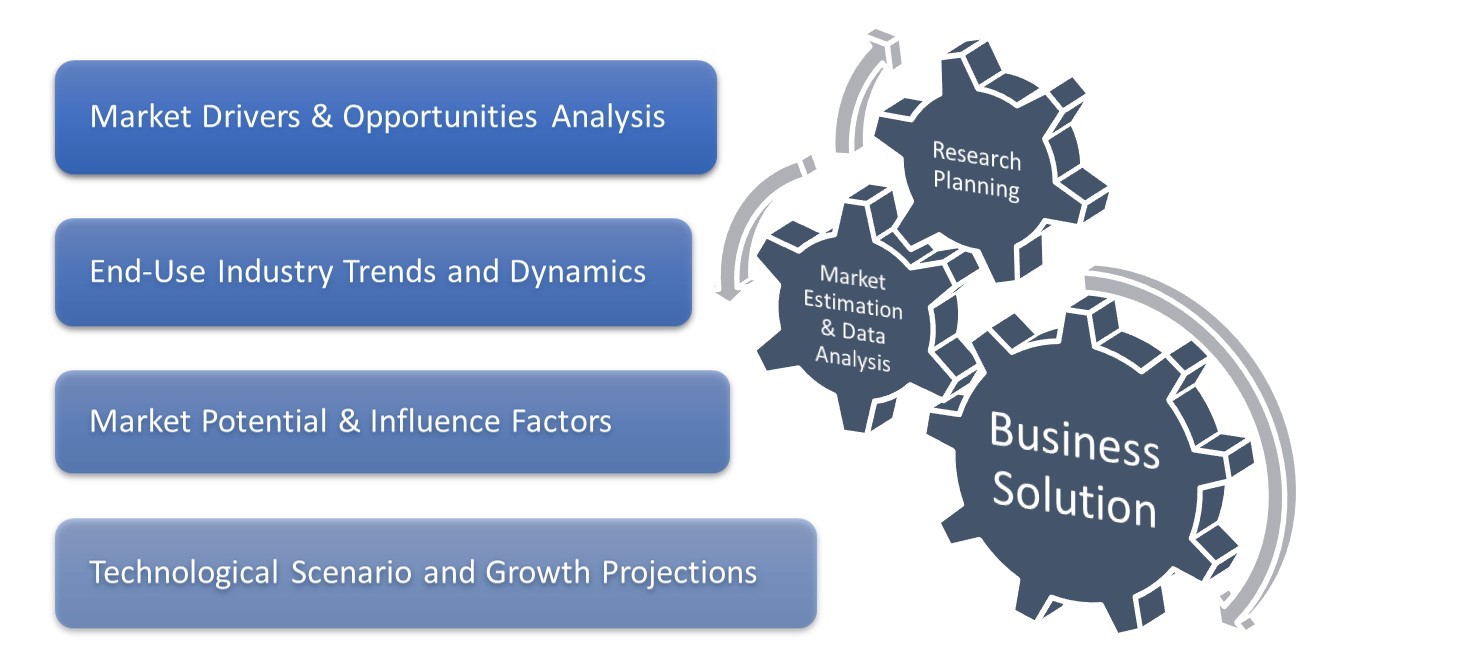

This research study involves broad usage of both secondary and primary data sources. The research process involves the identification of numerous factors which affect the industry, comprising the market environment, government policy, historical data, present trends in the market, competitive landscape, technological innovation, upcoming technologies and the technical progress in related industry, and market risks, opportunities, market barriers and challenges.

Market Estimation

Top-down and bottom-up approaches are used for validating the market size for companies, regional segments along with relevant market segmentations such as product type and application.

This report includes market estimations which are based on the marketed sale price of a product. Further breakdown of product segments, particular market share are formed based on the weightage assigned to every segment, which is derived of their usage rate and average price. The entire probable factors which effect the markets and influence them in a great way are included in this research report; and have been accounted for, studied in-depth and are confirmed through primary research. These are then studies to get the final qualitative and quantitative data. Any of the factors such as the outcome of inflation, economic downfall, and any kind of policy and regulatory alterations and/or other such factors are not accounted for in the market forecast. All of this data is amalgamated and included with thorough inputs and analysis from Gravitas Market Insights is curated in this report.

Along with the previously mentioned approaches, various data triangulation methods, in order to conduct market estimations and market forecasting for the complete market segments are detailed in this report. Key Companies present in the said market are also acknowledged via in-depth secondary research and primary research.

Section 1: Executive Summary

1.1. Usage-based Insurance (UBI) Market Industry 360° outline, Year 2016 – 2028

1.2. Business Model Trends

1.3. Growth Trends

1.4. End-User/Technology Trends

1.5. Regional Trends

Section 2: Market Dynamics - Usage-based Insurance (UBI) Market Industry Insights

2.1. Growth Drivers

2.2. Opportunities

2.3. Industry challenges

2.4. SWOT Analysis

2.5. Porter’s Analysis

2.6. Worldwide Industry Landscape, Year 2016 – 2028

2.7. Industry Segmentation

2.8. Technology & Invention landscape

2.9. Regional Landscape

2.9.1. North America

2.9.2. Europe

2.9.3. Asia-Pacific

2.9.4. South America

2.9.5. Middle East & Africa

2.10. Competitive Environment

Section 3: Global Usage-based Insurance (UBI) Market, By Package

3.1. Segmentation Analysis, By Package, 2016-2028

3.2. Market Share Segmentation Analysis, By Package, 2016-2028

3.3. Pay-As-You-Drive (PAYD)

3.3.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

3.4. Pay-How-You-Drive (PHYD)

3.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

Section 4: Global Usage-based Insurance (UBI) Market, By Technology

4.1. Segmentation Analysis, By Technology, 2016-2028

4.2. Market Share Segmentation Analysis, By Technology, 2016-2028

4.3. Smartphone

4.3.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

4.4. OBD-II

4.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

4.5. Black Box

4.5.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

4.6. Embedded telematics

4.6.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

Section 5: Global Usage-based Insurance (UBI) Market, By Vehicle Type

5.1. Segmentation Analysis, By Vehicle Type, 2016-2028

5.2. Market Share Segmentation Analysis, By Vehicle Type, 2016-2028

5.3. Commercial vehicle

5.3.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

5.4. Passenger vehicle

5.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

Section 6: Global Usage-based Insurance (UBI) Market, Regional Analysis

6.1. Global Usage-based Insurance (UBI) Market, Regional Analysis

6.2. North America, Country level Analysis

6.2.1. North America Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Package, 2016 – 2028

6.2.2. North America Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Technology, 2016 – 2028

6.2.3. North America Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Vehicle Type, 2016 – 2028

6.2.4. United States

6.2.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.2.5. Canada

6.2.5.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.2.6. Mexico

6.2.6.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.3. Europe Country level Analysis

6.3.1. Europe Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Package, 2016 – 2028

6.3.2. Europe Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Technology, 2016 – 2028

6.3.3. Europe Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Vehicle Type, 2016 – 2028

6.3.4. UK

6.3.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.3.5. Germany

6.3.5.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.3.6. France

6.3.6.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.3.7. Italy

6.3.7.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.3.8. Spain

6.3.8.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.3.9. Russia

6.3.9.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.3.10. Rest of Europe

6.3.10.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.4. Asia-Pacific Country level Analysis

6.4.1. Asia-Pacific Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Package, 2016 – 2028

6.4.2. Asia-Pacific Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Technology, 2016 – 2028

6.4.3. Asia-Pacific Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Vehicle Type, 2016 – 2028

6.4.4. China

6.4.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.4.5. India

6.4.5.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.4.6. Japan

6.4.6.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.4.7. Korea

6.4.7.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.4.8. Australia

6.4.8.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.4.9. Southeast Asia

6.4.9.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.4.10. Rest of Asia-Pacific

6.4.10.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.5. South America Country level Analysis

6.5.1. South America Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Package, 2016 – 2028

6.5.2. South America Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Technology, 2016 – 2028

6.5.3. South America Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Vehicle Type, 2016 – 2028

6.5.4. Brazil

6.5.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.5.5. Argentina

6.5.5.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.5.6. Colombia

6.5.6.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.5.7. Rest of South America

6.5.7.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.6. Middle East & Africa Country level Analysis

6.6.1. MEA Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Package, 2016 – 2028

6.6.2. MEA Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Technology, 2016 – 2028

6.6.3. MEA Usage-based Insurance (UBI) Market estimates and forecast with Growth rate analysis, By Vehicle Type, 2016 – 2028

6.6.4. GCC

6.6.4.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.6.5. South Africa

6.6.5.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

6.6.6. Rest of Middle East & Africa

6.6.6.1. Market estimates and forecast with Growth rate analysis, 2016 – 2028

Section 7: Company Profile - Usage-based Insurance (UBI) Market

7.1. Allstate Insurance Company

7.1.1. Business Overview

7.1.2. Product & Service Offering

7.1.3. Overall Revenue

7.1.4. Strategic Outlook

7.2. Aviva plc

7.2.1. Business Overview

7.2.2. Product & Service Offering

7.2.3. Overall Revenue

7.2.4. Strategic Outlook

7.3. Allianz SE

7.3.1. Business Overview

7.3.2. Product & Service Offering

7.3.3. Overall Revenue

7.3.4. Strategic Outlook

7.4. ASSICURAZIONI GENERALI S.P.A.

7.4.1. Business Overview

7.4.2. Product & Service Offering

7.4.3. Overall Revenue

7.4.4. Strategic Outlook

7.5. Cambridge Mobile Telematics

7.5.1. Business Overview

7.5.2. Product & Service Offering

7.5.3. Overall Revenue

7.5.4. Strategic Outlook

7.6. AXA

7.6.1. Business Overview

7.6.2. Product & Service Offering

7.6.3. Overall Revenue

7.6.4. Strategic Outlook

7.7. Danlaw, Inc.

7.7.1. Business Overview

7.7.2. Product & Service Offering

7.7.3. Overall Revenue

7.7.4. Strategic Outlook

7.8. Intelligent Mechatronic Systems Inc.

7.8.1. Business Overview

7.8.2. Product & Service Offering

7.8.3. Overall Revenue

7.8.4. Strategic Outlook

7.9. Desjardins Group

7.9.1. Business Overview

7.9.2. Product & Service Offering

7.9.3. Overall Revenue

7.9.4. Strategic Outlook

7.10. Liberty Mutual Insurance

7.10.1. Business Overview

7.10.2. Product & Service Offering

7.10.3. Overall Revenue

7.10.4. Strategic Outlook

7.11. Metromile Inc.

7.11.1. Business Overview

7.11.2. Product & Service Offering

7.11.3. Overall Revenue

7.11.4. Strategic Outlook

*Market size and forecast will be provided from 2016-2028, and forecast period would be 2021-2028

*Details on financial performance and strategic moves and developments may not be captured for unlisted companies

*List of companies profiled in this TOC is tentative and may change after detailed analysis